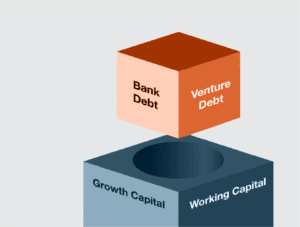

During introductory conversations we are often asked, “Vistara provides Venture Debt, right?” Our response is invariably the same, “well, not exactly, we don’t see ourselves as Venture Debt, but rather a provider of what we call Growth Debt.”

This isn’t marketing spin, as there is an important distinction between the two.

Venture Debt is commonly thought of as any type of loan to a technology company that is not yet profitable and thus, can’t qualify for a traditional asset-backed or cash flow loan. Loan proceeds are typically invested to build additional scale, with a focus on top-line revenues rather than immediate cash flow generation. This extremely broad definition encompasses both Venture Debt and Growth Debt, and as described in more detail here. We believe that debt-based solutions can be a great way for companies to seize growth opportunities while at the same time minimizing overall dilution for founders, early angel and venture shareholders, and the growth equity funds alongside whom we often participate.

So, what is the main difference between Growth Debt and Venture Debt? Growth Debt is principally a bet on the company, while Venture Debt is principally a bet on the company’s investors. Both are valid strategies, but evaluating a company’s ability to grow and eventually achieve profitability vs. likelihood that investors continue to support a company in good times and bad are two completely different analyses. At Vistara Growth, we describe our flexible financing solutions – often non-amortizing (interest-only) term debt or convertible debt – as Growth Debt. We do so as we focus almost entirely on the quality of the business, path towards profitability (still not required up front), the management team, and the company’s ongoing ability to service and eventually repay the debt rather than which venture capital funds chose to back the company, for how much, and how recently (hint: Venture Debt is easiest to attain immediately after a large round of “fresh” equity).

Rather than speaking theoretically, let’s get into an example.

| Venture Debt vs. Growth Debt Company Investment Scenarios | Venture Debt | Growth Debt |

| Last Round Raise | Recent Series B @ $30M | Not as relevant |

| Annual Revenue Run Rate | $15M | $15M |

| Annual Cash Burn Rate | $20M | $5-7M (looking to break even in a foreseeable horizon) |

| Loan Amount | $10M | $10M |

| Investment Rationale | Principally underwritten on basis of equity investors continued support | Principally underwritten on basis of company’s ability to achieve growth milestones, and path to profitability |

Let’s start with a Venture Debt example of a company with a run rate of $15M in revenue with a burn rate of $20M per year that has just raised a Series B round of $30M. On the back of the Series B raise, a lender provides a $10M loan. It is fair to say that a $10M loan to a company that is burning $20M per year is principally underwritten on the basis of the equity investors continued support, not necessarily on the ability of the business to service the loan.

While Vistara works very well with ambitious, venture-backed companies and their venture and growth equity investors, our approach is never based on “looking through” the business to the venture investors supporting a company. When we enter into a partnership with a company, our investment is based on our view of the quality of the underlying business itself rather than just its equity backers. This is a more comfortable position for company management and its investors as it avoids the high-pressure situation where management and the lender are both looking to the investors to write cheques rather than collaborating on how best to run the business.

As for growth debt, an example of where our approach tends to work well would be a company with $15M revenue that anticipates burning $5-7M in total before reaching break even operation in 12 – 24 months. Along the way, company management can assess whether to raise more capital and maintain their burn rate or move to focusing on profitability and cash generation. In this case, a $10M growth debt investment would be a bet on the company’s ability to achieve their stated milestones without relying solely on equity investors to inject more cash. We always look to invest in businesses with strong growth now and cash flow potential later, and we are proud to say that the portfolio of companies that we have partnered with, some of which are burning and some of which are generating cash flow, all reflect this approach.

This focus on the resilience and growth prospects of the underlying business rather than who has previously invested or when investments were made is why we are able to not only invest in venture-backed companies but also those considered “non-sponsored”, “lightly sponsored” or even “bootstrapped”. The focus on company fundamentals rather than the date and size of the last round also lends itself very well to venture-backed companies that have not had a recent investment round. At Vistara, we don’t rely on a formulaic approach (such as a percentage of the last equity round amount as is the case of pure Venture Debt) to decide on the appropriate size for our investments – instead we take far greater account of the characteristics of the business itself, which we are careful to take the time to understand in detail with management teams. In summary, while we at Vistara Growth are excited to partner alongside venture and growth equity investors and often do so, we are primarily focused on providing Growth Debt to successful businesses with great prospects on their own merit rather than relying on formal commitments or other confrontational provisions, such as “investor support” clauses from the venture investors behind them. With this lens, we are afforded the opportunity to work with great companies and likeminded founders and management teams, as well investors of all shapes and sizes.

About Vistara Growth

Vistara Growth provides highly flexible growth debt and equity solutions to leading technology companies across North America. Founded, managed, and funded by seasoned technology finance and operating executives, “Vistara” (Sanskrit for “expansion”) is focused on enabling growth for the ambitious entrepreneurs we invest in, our investors, our people, and the communities we operate in. For more information, visit vistaragrowth.com

Looking for Debt or Equity?

Read our case studies to learn how our flexible and tailored growth capital solutions have helped our portfolio companies.