Short-Term Debt Is NOT Growth Capital: The Curious Case of Company-Lender Product-Market (Mis)Fit

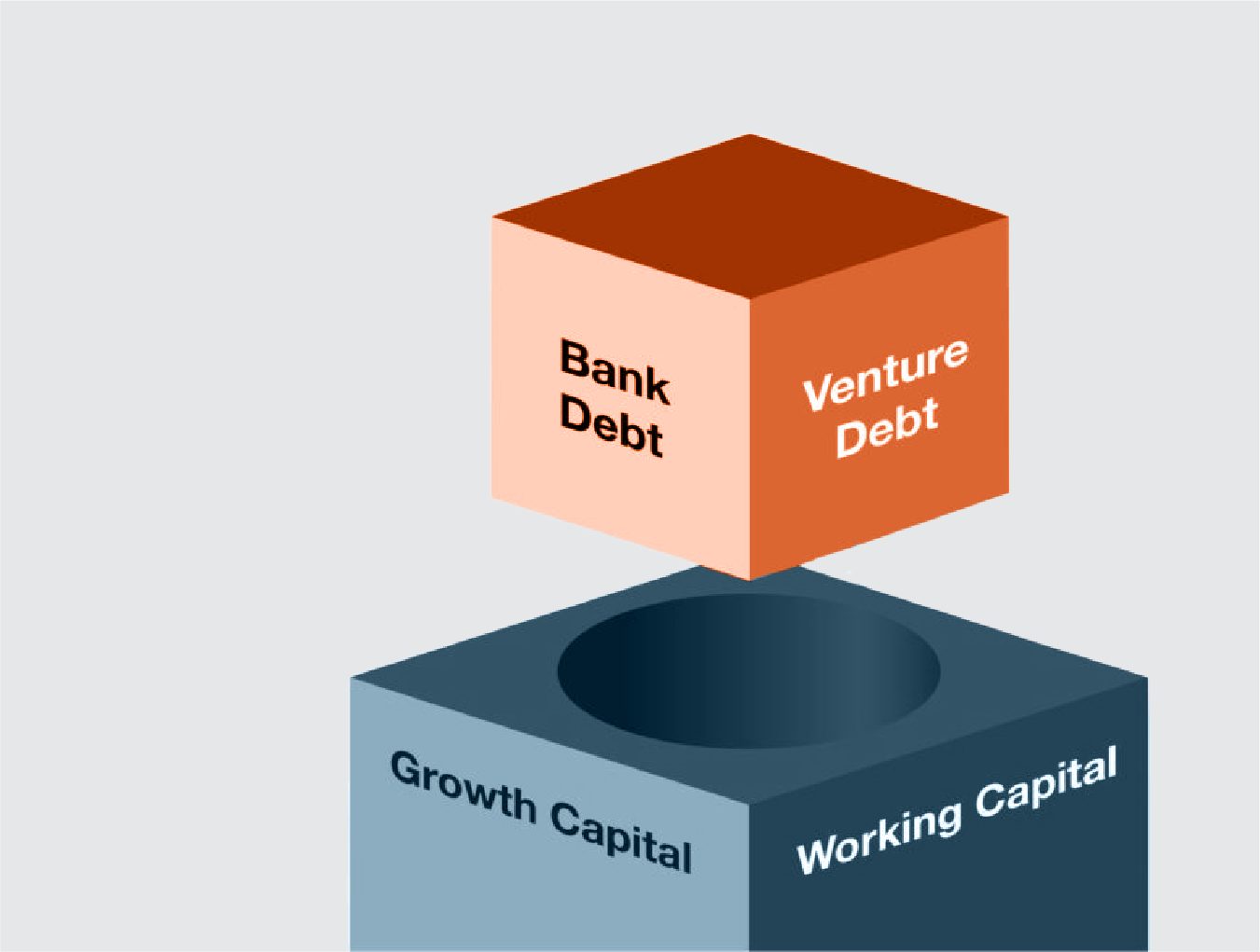

Bank lines of credit are inexpensive and flexible, and almost every tech company of sufficient scale should have one. Vistara Growth works with many great US and Canadian banks that support the tech community. With that said, most bank loans are not longer term growth capital, nor are they an emergency rainy day fund, a difficult lesson many tech companies are now coming to terms with. The problem is not with the banks (their mandate is minimal risk loans + fees for financial services), nor with tech companies (their mandate is to prioritize growth and build big global businesses) but a lack of product-market fit that is exposed when times get tough for either party.

How long does it take to develop and launch a product, hire and ramp sales staff, and onboard customers before finally making a return on those investments? While product dependent, the answer is never less than a year or two. Yet, bank lines of credit (LOC) usually renew on a yearly basis; if talking about bank term debt, these loans require large monthly payments of the loan principal after a 6, 12, or 18 months interest-only period, a short principal holiday or a “teaser” period. For the CFOs of companies in growth mode with ambitious product roadmaps and multi-year payback periods, neither form of bank debt seems to fit quite right.

For many years, tech companies have become accustomed to easily renewing and increasing their credit facilities, or refinancing before their teaser period ends. CFOs rightly took advantage of positive market conditions in which banks were all competing for market share.

Thankfully, the banks we work with are currently following through on their existing commitments and some are even providing temporary reprieve (e.g. deferral of principal payments on term debt for 3-6 months). However, new bank commitments often follow large equity financings, and with fewer, smaller financing venture equity rounds to comfort the banks, both refinancing and renewal conversations will become increasingly difficult.

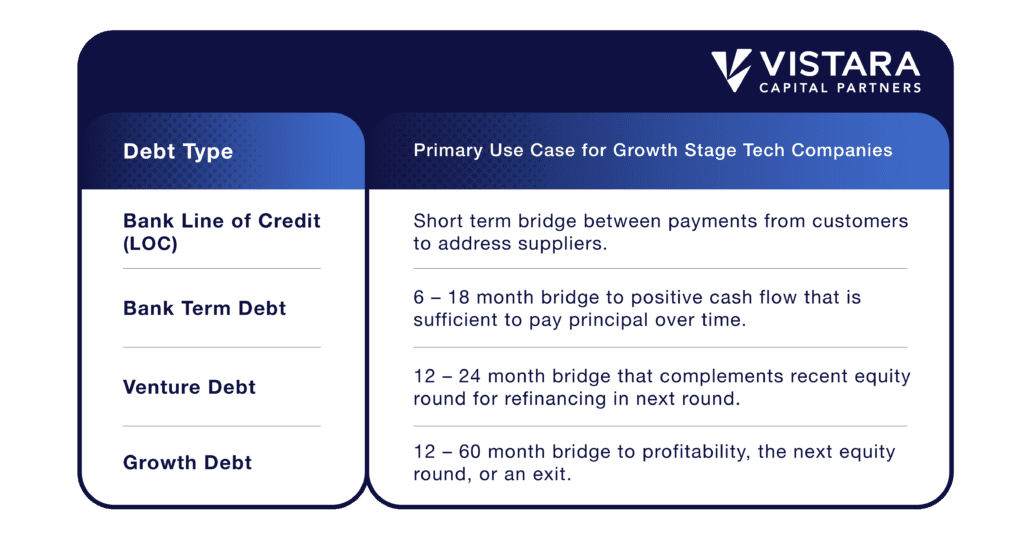

Technology companies prioritizing growth over cash flow need to understand the product-market fit of each type of loan. Debt must be serviced by positive cash flows or otherwise refinanced, so that debt for growth stage tech companies is always a “bridge” to either profitability or an event (equity financing, exit, IPO).

The use cases of debt for mid-later stage growth-oriented tech companies below are not exhaustive (which we plan to tackle in another post), but as a high-level overview can be summarized as:

All the above have their time and place, and are often used in combination with one another to serve a specific purpose. Marketing automation like Marketo is complementary to a CRM like Salesforce, but clearly not a substitute; similarly, a line of credit can be complementary, but is not a substitute for growth capital. Tech companies shouldn’t use venture debt when what is required is a line of credit, nor bank term debt when they need the flexibility of growth debt. Like a successful go-to-market campaign, the loan(s) you select should be targeted and address a very specific need.

At Vistara Growth, we focus on Growth Debt as we believe it best aligns with the practical reality of longer-term product and go-to-market investment cycles while proving to be less dilutive, allowing founders and early shareholders to own more of their growth. As such, we created a series of case studies that provide perspective for founders, executives, and existing investors of technology companies seeking to understand the differences, uses, and tradeoffs of financing growth with various forms and combinations of debt and equity.

Looking for Debt or Equity Funding?

Read our case studies to learn how our flexible and tailored growth capital solutions have helped our portfolio companies.