In spite of the many challenges over the past 12 months, our team at Vistara has managed to stay productive in what has been a very active time for growth funding and liquidity events across our portfolio.

We grew our team: Neil Kenley joined Vistara to help establish a Toronto presence in May 2020. We found and renovated new office space in Vancouver and our team is now back on hybrid schedules. We also had the privilege to announce the Vistara Elevate Awards, a scholarship and mentorship program for students of racially diverse backgrounds pursuing higher education in the areas of technology or finance.

Following is a brief overview of exits and a snapshot of new investment activity at Vistara. We look forward to continuing to support expansion at our portfolio companies and welcoming new technology companies across North America. If you’re interested in learning more about our flexible growth debt and growth equity solutions ranging from $5M – $25M, please contact us.

Exits

VIDEO APP DEVELOPMENT PLATFORM

WarnerMedia acquired You.i TV for its video development platform. Vistara initially made a Growth Equity investment in 2016 and a Growth Debt investment to complement the company’s Series C financing in 2017. Learn more.

WEALTH MANAGEMENT SOFTWARE

Investedge founders chose Vistara’s offering of Growth Debt over equity in 2016. As a result, the founders and employees were able to retain over 95% ownership of the business upon exit. Learn more.

DIGITAL COMMERCE SOFTWARE

Mobify was acquired by Salesforce to enhance their digital commerce experience capabilities. Vistara provided the Growth Debt investment portion of Mobify’s $15 million financing in 2017. Learn more.

New Investments

DIGITAL EXPERIENCE PLATFORM FOR FINANCIAL SERVICES

Kurtosys provides a platform that empowers global financial services firms to easily create, manage, and publish content in a secure and compliant environment. Vistara provided growth capital to accelerate the company’s growth and product enhancements. Learn more.

NETWORK OBSERVABILITY PLATFORM

Vistara led a growth funding round of US$23.5M in May for Kentik providing Growth Debt and Convertible Debt. Kentik provides a leading network observability platform for many of the world’s largest digital enterprises and service providers. Learn more.

COMMUNICATIONS SOFTWARE

Vistara provided US$8M in Growth Debt financing towards the acquisition of Geneva-based GSX Solutions. The acquisition extends Martello’s Digital Experience Monitoring capabilities to Microsoft Office 365 applications. Learn more.

CUSTOMER EXPERIENCE MANAGEMENT SOFTWARE

Vistara provided US$20M in Growth Debt financing to Alida (formerly Vision Critical), to support the company’s growth strategy for its Customer Experience Management and Insights offerings. Learn more.

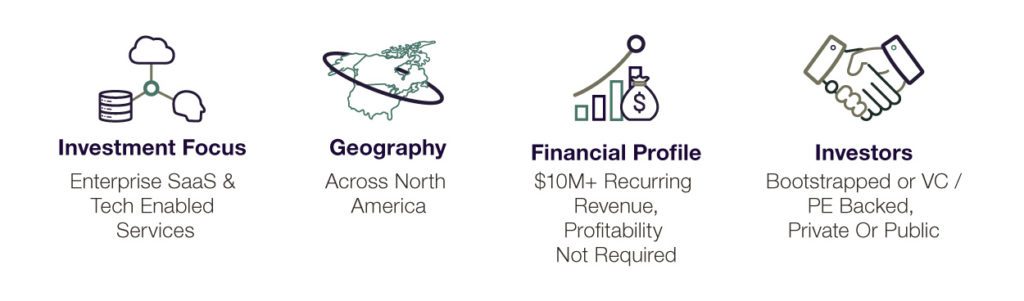

Target Company Profile

$5M-$25M Per Investment

Get in Touch

Looking for more information on our flexible growth capital solutions?