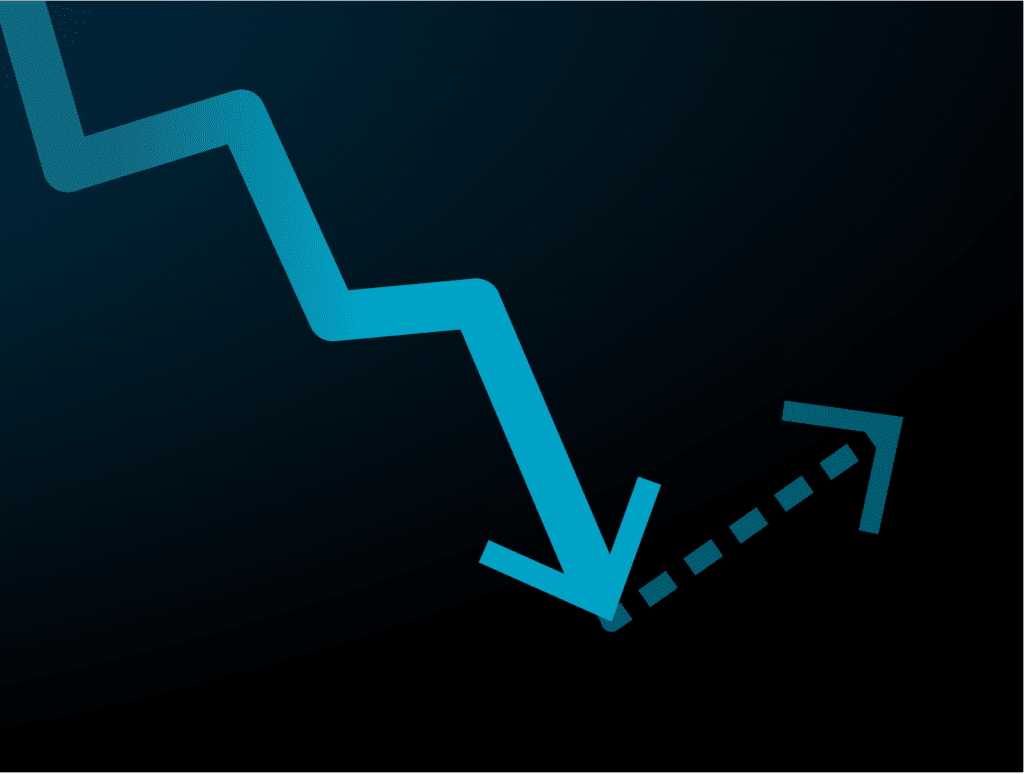

Valuations are far lower than a year ago, yet many investors are seeking liquidity even if that means selling at a discount to current lower valuation. Most tech companies have been incorrectly conditioned to think there is only downside in enabling liquidity at these valuations, and shareholder demands couldn’t come at a worse time. Instead, what if companies could benefit from this dynamic? Read on to learn how private tech companies can take a page out of the public company playbook, and by using Growth Debt, provide liquidity to sellers while materially benefitting the investors and employee shareholders in it for the long haul.

Accretive Buybacks: Public vs Private

Public companies often buy back stock when they believe their shares are undervalued. If the company believes its shares are worth $10, and are trading at $2-5 but will rebound over time, it often takes advantage and allocates available capital (from existing cash or issuing debt) to buying company stock for the benefit of its long-term holders. Even for companies with strong organic growth metrics, there aren’t many investments that can provide that ROI over a short period of time.

While buybacks – using company cash to buy and retire stock and shrink the number of shares outstanding – are somewhat rare with private technology companies, some experienced founders and their CFOs are using the lessons learned from public companies to buy back stock at much lower prices today than what they believe those shares might be worth in the future. At Vistara Growth we have had first-hand experience working with companies that have successfully completed such accretive buybacks. Contact us to discuss >>

Private companies don’t often consider this option, and only help facilitate “secondary” transactions – one investor selling to another – that satisfy a seller’s desire for liquidity but don’t directly benefit the company as there is no new cash and no fewer shares, just swapping names on the cap table with the administrative hassle to go along with it.

While it’s not intuitive to use cash to buy back stock, but rather preserve it for growth initiatives, during a company’s lifecycle there are often unique opportunities to make existing and long-term shareholders happy by buying back stock at a discount that is acceptable to sellers but deemed well below market value by those remaining. Currently, many former employees, angel investors, and funds at various stages are seeking liquidity for differing but legitimate reasons, as indicated below:

If this was a public company, it might just go into the market and buy stock. It’s more complicated for private companies given various rights of preferred shareholders, but far from impossible and while not publicly announced is a strategy executed by private companies in all market conditions.

Pulling it off with Growth Debt

So, how do companies pull off an “accretive” buyback that is a win-win for selling shareholders, remaining shareholders, and the company itself? One creative strategy is to use Growth Debt rather than using existing balance sheet cash. Companies often also raise further amounts on the same debt facility for a variety of other growth capital use cases alongside funds needed for the buyback. That debt is then typically paid back in a future equity raise or company sale at a higher share price than the buyback. As with taking on any debt capital at a growing tech company for a buyback or otherwise, the key is ensuring the terms enable rather than restrict growth and provide 3+ years without requirement for principal repayment, as it may take longer than expected to achieve that higher valuation event making it all worthwhile.

The ability to continue growing and not only manage dilution but actually increase ownership along the way is an enticing option for many private companies that thought this strategy was only available to public companies.

Interested in learning more? Click below to discuss how Vistara portfolio companies have pulled off the private company buyback with great success.

About Vistara Growth

Vistara Growth provides highly flexible growth debt and equity solutions to leading technology companies across North America. Founded, managed, and funded by seasoned technology finance and operating executives, “Vistara” (Sanskrit for “expansion”) is focused on enabling growth for the ambitious entrepreneurs we invest in, our investors, our people, and the communities we operate in. For more information, visit vistaragrowth.com

Looking for Flexible Growth Capital?

Read our case studies to learn how our growth debt and equity solutions have enabled our founders and helped our portfolio companies.